THE BUZZING FINTECH PARTY OF INDIA

First things first, the buzzword ‘FinTech’, What does it mean? What it is all about?

As the name goes ‘FinTech’, It is a blended form of Finance + Technology & It uses revolutionizing concepts in the financial industry. It encapsulates everything any company is trying to do with the technology within the financial domain. Technology is such a saviour for mankind or humanity, Whichever the topic be, just add technology into it, your job will be Done & Dusted in a way more convenient & easier way. “The major winners will be financial services companies that will embrace technology”, The quote that rightly serves justice to the hot topic ‘FinTech’.

As in the pandemic timeline, the two industries which gained a massive boom are The FinTech Industry & Pharmaceutical Industry, Wherein the financial year 2021, Demat account openings hit a record of 14.2 million, from this you can get a clue how the FinTech Industry flourished.

Over the past few years, many complex concepts like data science, artificial intelligence and blockchain have received wide fame. A lot of industries have understood the brilliance and usability of these concepts and have started incorporating them. One of those industries is the financial industry. FinTech has made banking for businesses and customers quite convenient. As compared to traditional banks, FinTech start-ups are more efficient in fulfilling their customers’ demands.

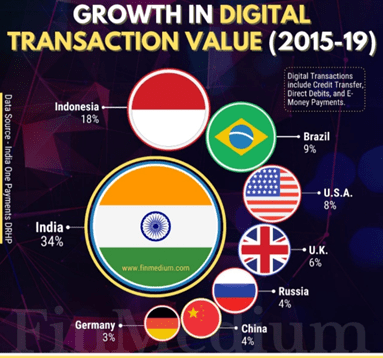

Here are some interesting statistical data & a reality checks into the FinTech industry: –

- India has the highest FinTech adoption rate globally.

- In total, 64% of consumers worldwide have used one or more FinTech platforms.

- The total transaction value of digital payments grew from $4.1 trillion in 2019 to $5.2 trillion in 2020.

Some of the most preferred uses of FinTech are: –

- Payments: –

The process of transferring money around has become effortless with the help of FinTech. With the help of a payment app, you can transfer funds to anyone with just a few clicks.

Players: – Apple Pay, Google Pay, Paytm, etc

- Investments: –

FinTech has completely changed the way people invest in the stock market. A lot of investing barriers have been broken down with the help of new trading platforms.

Players: – Upstox (Backed by Sir Ratan Tata), Grow App, ET Money, etc

- Cryptocurrency: –

Concepts like cryptocurrency and blockchain when combined with FinTech can deliver a whole new kind of financial services.

Players: – Coindcx, CoinSwitch Kuber, WazirX, etc

- Lending: –

This industry is increasing the approval process and making the process of lending easy. Anyone from around the world can apply for a loan from their mobile devices. The new data points, functional risk models are providing credit to remote locations.

Players: – MobKwik, Money Tap, Neo Growth, etc

- Insurance: –

Companies have recently branched out into the insurance market too. Many companies in this category are focusing on distribution. They’re using new technologies like apps to reach customers that are underserved by insurance. They’re also more flexible than traditional insurers.

Players: – Acko, Policy Bazaar, Pentation Analytics, etc

I am a second year finance student. Very much intrigued about stock market and finance. Passionate and love to have insights on almost any topic you name. Fascinated about learning new things. My blog posts will help you all to have a deep dive onto my topics.

This so informative, really liked this blog and the following content. keep doing the good.